Struggling to get a personal loan due to a zero or low CIBIL score? Don’t worry, you can still avail of an instant loan without a CIBIL score. While traditional banks and NBFCs often require a good credit score to approve loan applications, many fintech platforms and instant cash apps now offer quick personal loans without CIBIL checks.

This article explains how you can apply for a short-term instant loan without a credit history, the eligibility criteria, and why digital loan apps are becoming a preferred option for quick financial support.

Why CIBIL Score Not Always Necessary?

CIBIL score is a key measure of creditworthiness. A score above 700 is often considered ideal. However, for individuals with no credit history or a low score, getting a loan from traditional banks can be difficult.

Fintech platforms and NBFCs now use alternate credit models such as income verification, employment status, and digital KYC to assess loan eligibility. This opens the door for first-time borrowers, students, and salaried professionals without a CIBIL score to secure financial assistance easily.

Comparison of Instant Loan Apps Without CIBIL or Income Proof

| App Name | Best For | Loan Amount | CIBIL Required | Income Proof Required | Disbursal Time | User Category |

|---|---|---|---|---|---|---|

| mPokket | Students | ₹500 – ₹30,000 | No | No (for students) | Minutes | Student-Friendly |

| KreditBee | First-time borrowers | ₹1,000 – ₹3,00,000 | No | Optional (small loans) | 10–15 minutes | Low-Income / Self-Employed |

| Dhani | Credit line access | ₹1,000 – ₹5,00,000 | No | No (for small usage) | Instant | Low-Income / Student-Friendly |

| TrueBalance | Emergency cash | ₹1,000 – ₹50,000 | No | No (lower amounts) | Instant to a few hours | Low-Income / Self-Employed |

| Slice | Young professionals | ₹2,000 – ₹10,00,000 | No | Optional | Instant credit line | Student-Friendly / Low-Income |

| StashFin | No/poor credit score | ₹1,000 – ₹5,00,000 | No | Yes (flexible) | Within 4 hours | Self-Employed / Low-Income |

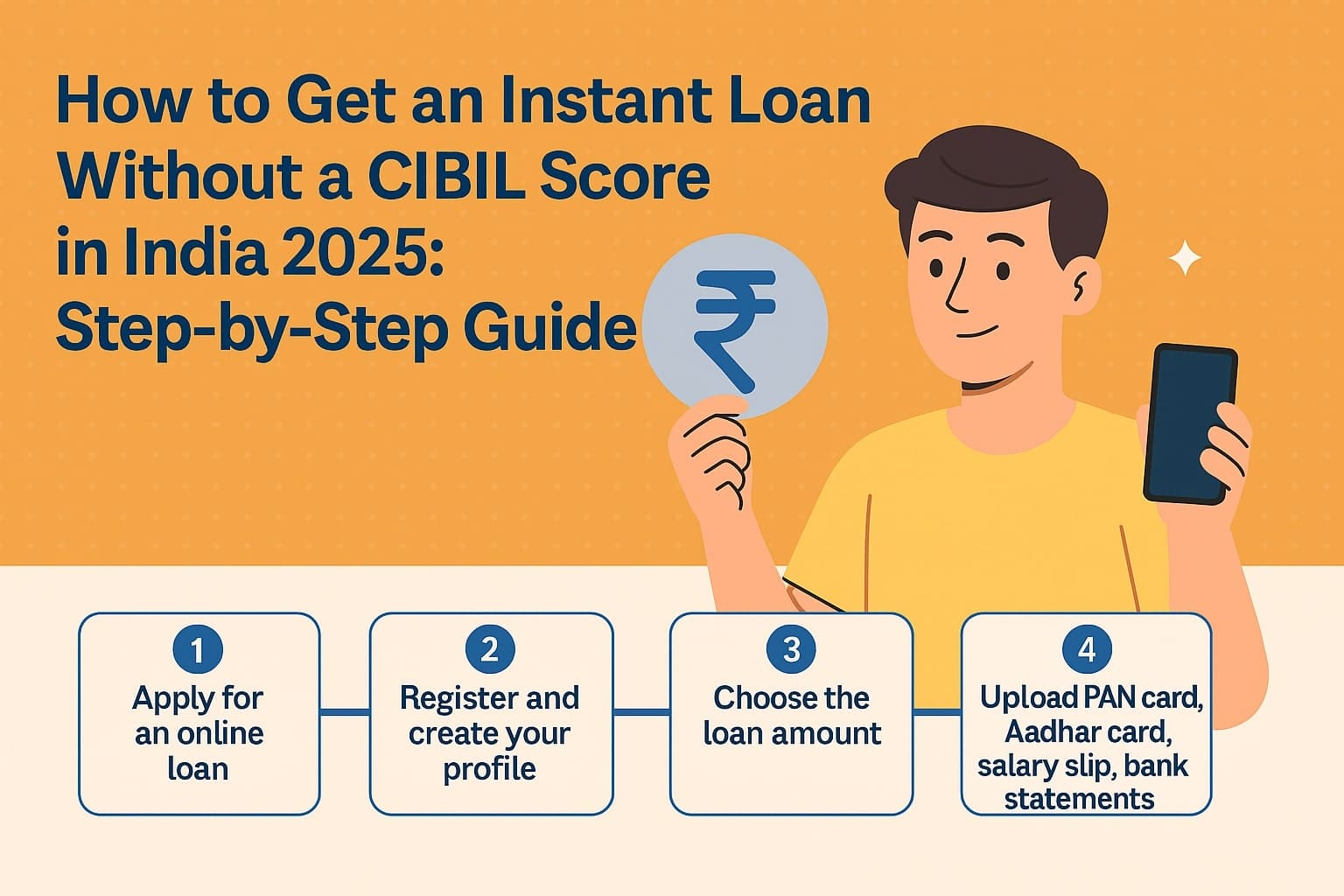

Steps to Avail an Instant Loan Without a CIBIL Score

Follow these steps to apply for an instant personal loan without a credit score:

1. Apply Online via Loan Apps or Websites

Visit the official website of platforms like mPokket or download their mobile app. The process is completely digital, and no physical documentation is required.

2. Complete Registration

Create your profile by providing basic personal and employment-related details such as:

• Full name and contact details

• Date of birth

• Employer name and type

• Monthly income

3. Choose Loan Amount

Select the loan amount you want to apply for. If you don’t have a CIBIL score, it’s advisable to start with a smaller amount to increase approval chances.

4. Upload Required Documents

Ensure you upload clear copies of the following documents:

• PAN Card

• Aadhaar Card

• Latest salary slip

• Last 3–6 months’ bank statements showing income and credit

Tips to Improve Approval Chances

Apply for a Smaller Loan

Applicants without a CIBIL score should start small. A smaller loan amount poses a lower risk for the lender and increases the chances of approval.

Add a Guarantor

If possible, apply with a co-applicant or guarantor who has a good credit history. This adds a layer of assurance for the lender.

Show Proof of Stable Income

Income stability is a key factor. Submitting your salary slips and bank statements strengthens your application.

Benefits of Using Quick Loan Apps like KreditBee

• No CIBIL Check Required: Ideal for first-time borrowers or those without a credit score

• 100% Digital Process: Apply from your smartphone or desktop without visiting any branch

• Fast Disbursal: The Loan amount is transferred to your account within 6 hours of document verification

• Flexible Usage: Use funds for travel, medical emergencies, education, or weddings

• Trusted Platform: Kredit Bee and similar NBFCs are regulated and reliable

Who Can Apply?

• Salaried individuals with a minimum monthly income (varies by lender)

• Age between 21 to 58 years

• Must have valid PAN and Aadhaar

• Should have an active bank account with consistent salary credits

Frequently Asked Questions (FAQs)

Q: Can I get an instant loan without any credit history?

Yes, platforms like mPokket or LazyPay offer loans even if you have no CIBIL score or credit history.

Q: How fast is the loan disbursed?

Once your documents are verified, the loan is typically disbursed within 6 hours.

Q: Is physical documentation required?

No. The process is completely online and paperless.

Q: What if I’m a first-time borrower?

You can still get approved if you have a steady income and meet other eligibility criteria.

Q: Can I apply again if my loan is rejected?

Yes, but it’s best to reapply after checking and improving your eligibility (e.g., add a guarantor or apply for a lower amount).

Final Thoughts

Getting an instant personal loan without a CIBIL score is now possible thanks to evolving financial technology. Platforms like mPokket or KreditBee make borrowing simple, fast, and accessible to individuals who may have struggled with traditional lenders. With just a few documents and a smartphone, you can secure the funds you need, whether for an emergency or planned expense.

Disclaimer: Loan approval and disbursal depend on the lender’s internal criteria and verification process. Always read the terms and conditions before applying.